Get AP Automation Right the First Time

Say goodbye to tedious manual tasks, pesky errors and endless reconciliations with a full-fledged solution that streamlines workflows, tracks with ninja-like precision, and serves up compliance and reporting as solid as a rock.

Solution highlights

AP Automated – Accounts Payable Software Powered by AI

Our end-to-end AP automation doesn’t just make AP processes manageable; it makes them seamless. From supplier onboarding, automated invoice management to direct ERP integration.

Be on top of your AP function

AP Automated’s dashboard keeps you and your team current with smart notifications and quick access to approvals, analytics and reports.

Smart routing for approvals

No more chasing down individuals to approve invoices. Our smart approval routing intelligence and interface speeds up the entire process with dashboard and e-mail reminders and notifications.

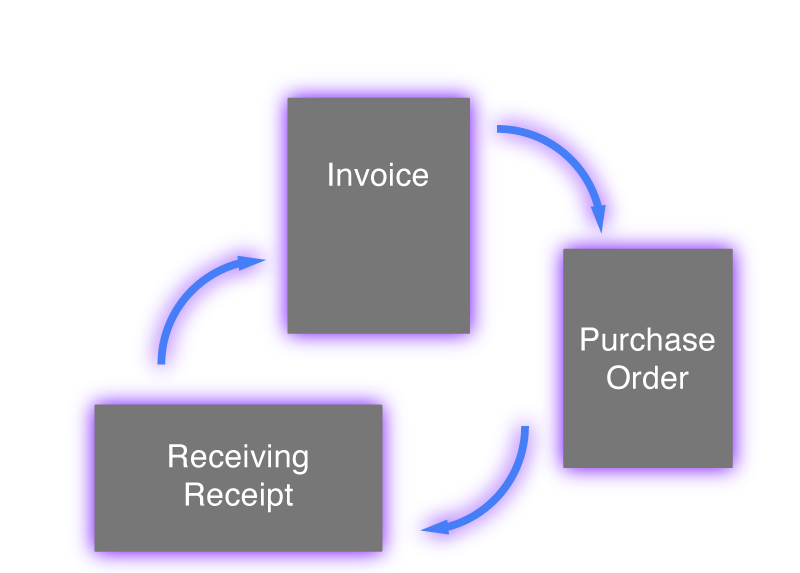

Two- and three-way PO matching

The 3-way match process serves as the optimal internal control method by eliminating any incorrect and fraudulent invoices or payments within a company.

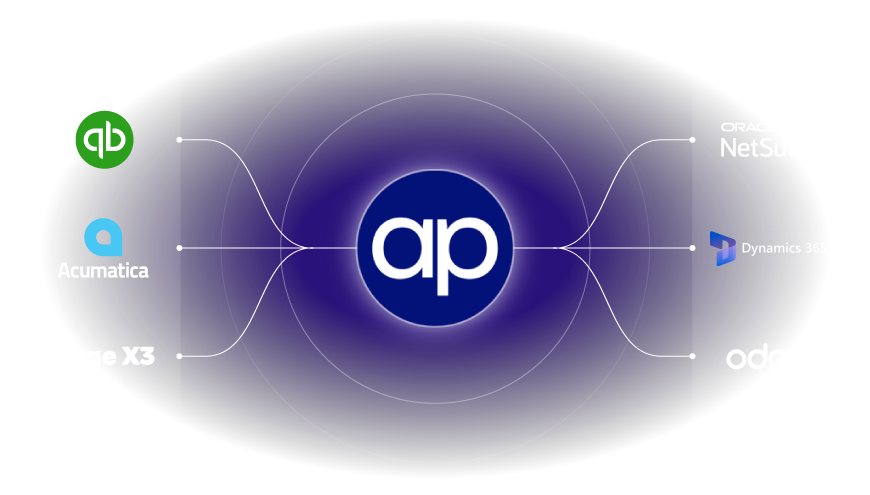

Integrate with your main ERP's AP

Hit the Ground Running on Day 1, Not Weeks or Months

AP Automated learns from your historical data so you can hit the ground running and see ROI on the first day.

ERP INTEGRATIONS

Seamlessly Integrate with your ERP

Speed up AP processing time by up to 70% with our cutting-edge AI. Reduce manual entries, auto-route invoicing approvals and see ROI on day one.

Besides our current integrations, get in touch with us to integrate AP Automated with your ERP.

Complete Integrations

Don’t just take our word for it,

hear what our customers have to say

AP Automation FAQs

How does AP Automated fix the invoice approval process?

AP Automated streamlines the accounts payable invoice approval process by identifying the correct approvers, sending notifications, and automating reminders. In addition, AP Automated enables businesses to keep all documents (Purchase Orders, receiving documents or receipts, and previous invoices) in one place so everyone has what they need to take action.

Can AP Automated help detect and avoid duplicate invoices?

Accounts payable software can incorporate features to detect and prevent duplicate invoices. Systems may utilize built-in financial controls and artificial intelligence to identify potential duplicates throughout the invoice processing workflow, from upload to approval, including checks against integrated systems. Upon detection, the software can provide alerts to users.

Does AP Automated deter invoice fraud?

In short, yes. AP Automated provides controls in more ways imaginable to mitigate fraud and improve security over your financials. An example of control for the invoice approval process—is by setting approval limits for a specific or all users. Or requiring an additional approver when a limit is reached or invoice amount is changed by AP. Reporting functionality tools also provide full control and visibility into suspicious activity by AP staff or management.

What is Accounts Payable Automation?

Accounts payable automation (AP automation) utilizes software to automate typical vendor invoice tasks, leading to increased efficiency within the payable department. This automation streamlines various processes such as paperless document management, invoice processing, purchase order (PO) matching, and payment reconciliation.

Traditionally, accounts payable teams have grappled with high overhead costs, manual data entry, and inefficiencies. However, with the adoption of an AP system, teams can scale operations without the necessity of additional staff, access enhanced visibility into financial data, and achieve a faster financial close by up to 25%.

When compared to accounts payable outsourcing, accounts payable software emerges as a more affordable, flexible, and user-friendly solution for optimizing invoice management processes.

How does AP automation software work?

AP automation software enhances the accounts payable process by targeting areas where manual tasks cause inefficiencies, such as invoice processing, mass payments, data entry, and price matching.

The initial stage of invoice automation involves data capture, where the software automatically extracts invoice data and performs a comparison with the synced purchase order information, a process known as PO matching. Similarly, this functionality extends to other documents like inspection reports and shipping receipts.

Following this, the software routes the invoice to the appropriate approvers. Upon approval, it seamlessly transfers the invoice data to an integrated ERP system, while also archiving data from various sources including digital documents, paper invoices, and audit trails.

The adoption of AP automation software yields numerous benefits. It enables accounts payable teams to reduce costs, eliminate routine tasks, enhance visibility and control over financial data, streamline cash flow, and unlock opportunities for early payment discounts.

How does automation software help AP teams scale?

Automation in accounts payable (AP) is a crucial tool for modern CFOs looking to scale their teams efficiently. AP software facilitates growth by automating invoice processing, achieving cost savings, optimizing approval routing, strengthening vendor relationships, mitigating risks, and ensuring seamless integration.

By embracing automation, businesses can ensure timely and accurate payments, thereby enhancing supplier relationships, streamlining transactions, and preserving partnerships. Additionally, this approach can help prevent incurring late payment fees.

How much does a typical AP automation solution cost?

AP automation software pricing varies based on required functionalities and deployment methods. Key features typically include:

- Invoice Capture and Document Management: This involves scanning, archiving, and optical character recognition (OCR) for invoice data extraction.

- Workflow Automation and Controls: This encompasses approval workflows, automated matching, and internal control mechanisms.

- Data Integration and Reporting: This includes bi-directional integration with other systems, robotic process automation (RPA), and business intelligence tools.

Cost structures differ between on-premise and cloud-based solutions. On-premise systems generally involve annual license fees and support costs, while cloud-based options often utilize a transactional pricing model.

Does AP Automated integrate with ERP systems?

AP automation software can integrate with enterprise resource planning (ERP) systems to streamline accounts payable processes. Integrations facilitate the automated transfer of bill and payment data, potentially accelerating reconciliation. Pre-built integrations may exist for common ERP platforms like Sage X3, QuickBooks Online and Acumatica. The extent of integration is typically tailored to specific business requirements and workflows. Real-time data synchronization is a built-in feature in these integrations.

Does AP Automated help improve supplier relationships?

Accounts payable (AP) automation can enhance supplier management through several functionalities. Automated systems can provide real-time payment notifications and status updates, improving communication. Furthermore, these systems can facilitate vendor management and compliance by collecting and managing necessary tax documentation, such as VAT, W-8, and W-9 forms. Efficient payment processes and improved communication often contributes to stronger supplier relationships.

How does AP automation software help improve an AP department?

AP automation can influence the structure of an accounts payable department, primarily by facilitating the segregation of duties, a key element of internal control. This separation helps to mitigate fraud risks and clarify responsibilities. Furthermore, automation may necessitate the redefinition of roles within the department to optimize workflows and leverage the new technology.